Posted on October 2, 2022

- By The Numbers: The Pound Sterling ’s Busy Week

- Why was Bitfinex responsible for most of the growth?

There is heavy volatility in the sterling pound. Dollar is eating everything. The Bitcoin has fallen into deep sleep. This is a wonderful time to be alive. Things are moving and shaking in the finance world and the general population can’t do much but watch the show. Place their bets. British residents recently witnessed the dollar and sterling fall to their lowest levels in years. Charts show that bitcoin was the most popular response of a portion of the population.

Another important factor is that the pound sterling’s “volatility last week was highly unusual, creating opportunities and price discrepancies.” The currency crisis creates opportunities, and British traders seem to have taken advantage of them. As a reminder, the pound sterling saw “a feisty week in the UK pending proposed and later abandoned tax cuts.” This is all according to Arcane Research’s The Weekly Update.

Bitcoinist’s first reportOur sister website said the following:

“The UK’s interest in Bitcoin (BTC) will expand “quite quickly” as fiat currency instability makes the flagship digital currency asset resemble a stablecoin, analysts said.

As one of several this week to highlight BTC’s attractiveness over the pound sterling, strategy adviser at financial firm VanEck Gabor Gurbacs came to that decision.

“Because of the instability of the pound,” Gurbacs warned, “the United Kingdom will get orange-pilled very rapidly.”

The last factor to analyze is this one, “most of the growth was concentrated in spiking volumes on Bitfinex.” Why was that? Continue reading to learn more.

By The Numbers: The Pound Sterling ’s Busy Week

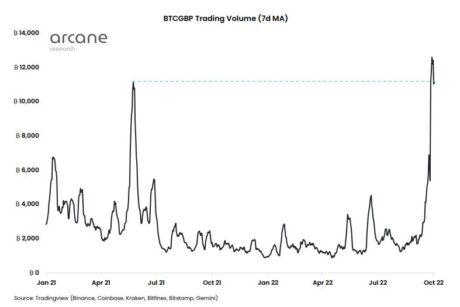

The headline is this one: the BTCGBP trading volume’s 7-day average reached an all-time high this week. Also, surprising no one, “similar tendencies occurred in ETHGBP.” How high was the all-time high, though? Back to The Weekly Update, “BTCGBP pairs saw trading volumes climbing above 47,000 BTC last Monday, after having experienced growth throughout the latter parts of September.”

Source:| Source: The Weekly Update

As for the reason for the pound sterling to bitcoin movements, Arcane Research’s analysts blame it on “market maker rebalancing.” Although they also recognize that bitcoin is “gaining mind share amidst declining trust in the British Pound.”

The same thing happened with the Russian ruble in the conflict against Ukraine. The time was, our sister site Bitcoinist reported:

“The new all-time high on the BTCRUB pair is the result of the Russian ruble falling more than 50% against the United States dollar since the start of the year. As the global reserve currency, most financial assets are priced in USD.”

Is the sterling pound likely to rebound at the same rate as the ruble? Or will it continue dominating for the foreseeable near future, the dollar?

Source: BTC/GBP at TradingView.com| Source: BTC/GBP on TradingView.com

Why was Bitfinex responsible for most of the growth?

Arcane Research analysts identified another interesting factor. If you like, an incentive. They named it a “prolonged structural mispricing” and it refers to a “dollar-adjusted premium or discount in Bitfinex’s BTCGBP pair last week.” All you have to do is adjust “the BTCGBP pair to USD,” to see that the pound sterling / bitcoin pair “traded at a significant discount to dollar spot.” This was an effect and not a cause. Arbitrage opportunities are created by the market movements. People who recognized the opportunity at the right time made money.

“As the GBP bottomed vs. the USD, BTCGBP traded at a massive discount compared to BTCUSD. The discount turned into a prolonged premium with certain wicks deep into discount terrains as GBP traded in a highly volatile environment.”

Despite the significance of this factor, Arcane Research still believes that “the predominant force was market makers reducing their exposure” to the pound sterling.